Property Taxes Are Due: Pay by December 10 to Avoid Penalties

11/28/18

San Diego County Treasurer-Tax Collector Dan McAllister reminded property owners to visit sdttc.com to pay their property taxes online soon or face a hefty penalty.

The first installment of the 2018-2019 secured property tax bill was

due on November 1 and will become delinquent after December 10. Owners

can pay by fast and free e-checks

if they click the "Pay Bill" button above.

“So far, we have had 41% percent of taxpayers send us $1.3 billion in first installment payments,” said McAllister, “but we’re coming up on the deadline, and we don’t want anyone to have to pay a 10 percent penalty for being even a minute late.”

Online payments will be accepted until midnight on Dec. 10. Taxpayers should log on early and give themselves plenty of time to complete a payment before the automatic midnight cutoff.

Payments can also be made by phone at 855-829-3773 or in person by visiting any of the five branch offices. Mail payments must be postmarked Dec. 10 to be considered on time.

“We recently redesigned our website in hopes that people will be able to easily find the information they need and pay on time,” said McAllister. “More than 60% of taxpayers now pay electronically because it is secure, fast and easy. I encourage everyone to skip the lines at our branches and go online.”

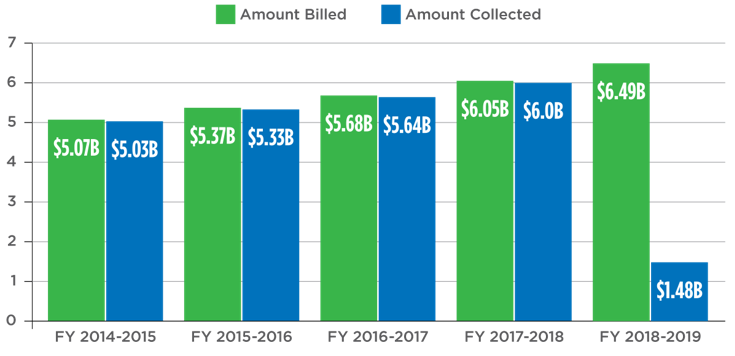

In September, the TTC sent out 998,298 tax bills, which are expected to generate $6.49 billion for the County of San Diego.

Property taxes fund schools, libraries and other services provided by local cities and the county. Click here to see how taxes are allocated.

Property Tax Collection History

Property Tax Payment Updates

-

Pay your property taxes by December 10th to avoid penalties.

Obtain a USPS postmark and mail your payment or you can pay online

until Midnight.

-

Check payment not cashed yet? We appreciate your patience.

Please do not put a stop payment on the check as it will result in

additional tax collector fees. The payment will be credited as of

the date received or postmarked. If the check has not cleared after

6 weeks, please submit a Request for Cancellation of Penalties based

on a lost check. You may find the form on our website by clicking here.

-

Payment made by your lender? Mortgage companies do not send

in their payments until right before the delinquent date. They may

have withdrawn the funds from you in November, but they compile the

funds and send a multi-million dollar wire (paying thousands of

parcels) right before the delinquent date. When we process their

payment, the website is normally updated within 48 to 72 hours. As

long as the wire was received by the delinquent date, the payment

will not be delinquent.

-

Did not receive a bill? If you did not receive your tax bill,

please access it online. The first installment will

become delinquent if unpaid after December 10th. The second

installment is due February 1, 2018, and will become delinquent if

unpaid after April 10, 2018. Failure to receive a tax bill will not

prevent penalties from being imposed on a late payment.